- Buy-to-Let Opportunity

- Holiday Let Opportunity

- Long-Term Tenants currently situated in Flat 1

- Likely to attract enquiries from Serious Investors & Developers

- Very Good Condition

- Three Piece Bathroom

- Spacious Lounge and Kitchen

- 3-minute walk to the beach and local amenities

- Dual-income potential from residential and short-term holiday lets

- INVESTMENT POTENTIAL DETAILED BELOW (Let Property Pack)

Originally a single large house, 1, 2 & 3 Marine Cottages consist of two self-contained flats and a cellar, offering a strong investment opportunity in a sought-after location.

This property is situated in Barmouth, just a short walk from a range of valuable amenities. It presents an excellent opportunity for investors seeking consistent, long-term returns.

This is a brilliant opportunity for investors!

Flat 1 (ground floor) offers a private entrance and features one bedroom, lounge, kitchen, bathroom, and a small entrance hallway.

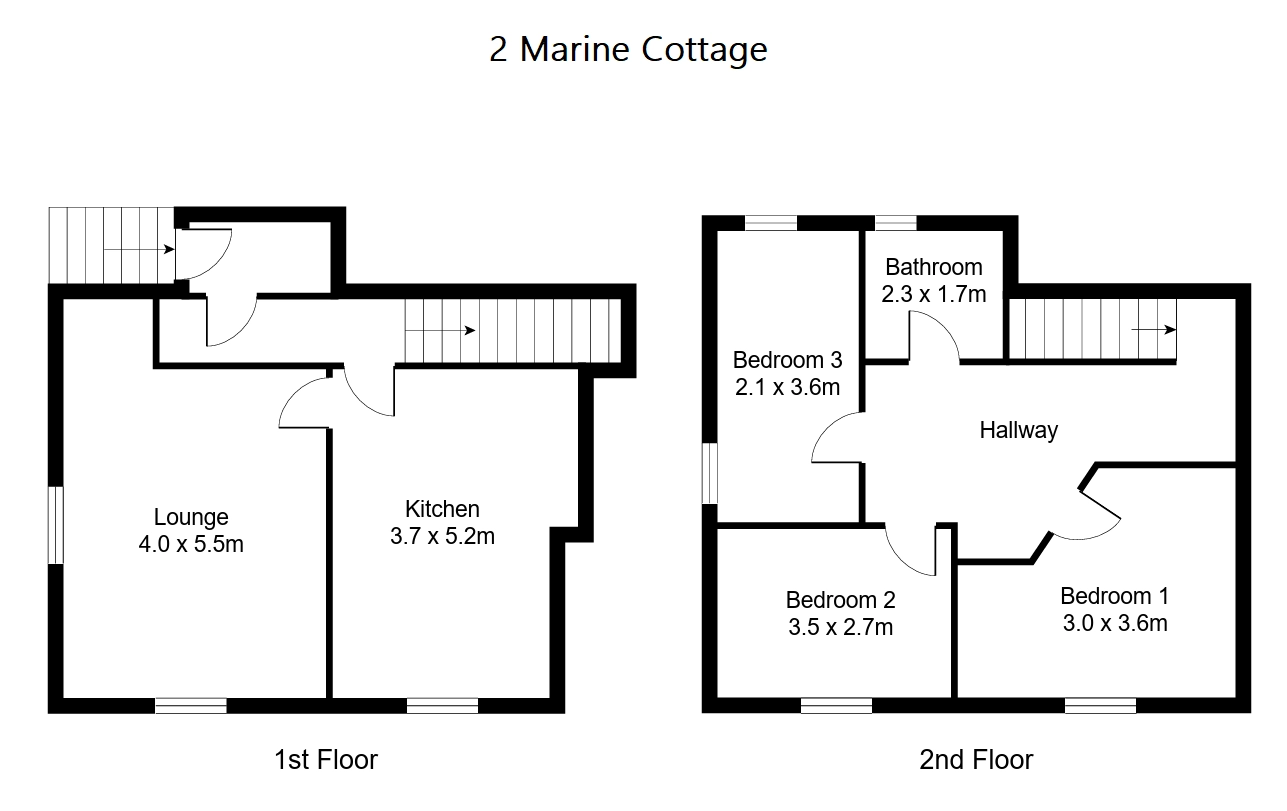

Flat 2 (1st and 2nd floor) offers a private entrance and features three bedrooms (2 doubles and one twin), a large lounge, kitchen/dining room and a three-piece bathroom with bath and shower. It is currently let year-round as a holiday rental via Airbnb.

Unit 3 is a cellar space with renovation potential. It could possibly be converted into a studio apartment, subject to planning permission and works

Investment Details:

The portfolio currently produces an annual gross income of £25,650 with tenants currently situated. Considering the purchase price and the potential rental income that could be earned in future years, this will make for a worthwhile addition to an investors property portfolio.

Please see the Let Property Pack linked below for more details on this property's investment potential.

Tenancy Details:

The current tenants have resided in the property for several years and have consistently paid their rent. They have no intentions of moving out and are keen to remain in the property.

Let Property is committed to facilitating a smooth transaction process between buyer and seller. To allow for maximum commitment to the sale from both parties, a Buyers Premium will apply in order to secure a property.

Tenancy Checks

Tenancy Agreement

Proof of Rental Income documentation has been verified against the rental amount in the Tenancy Agreement by Let Property.

Proof of Rental Income

Recent Proof of Rental Income has been Verified by Let Property.

Length of Tenancy

Length of Tenancy has been verified by Let Property by reviewing the date from when the provided tenancy documentation began.

Property Checks

Property Tenure

Verified as Freehold

Property Tenure documentation has been provided to Let Property and has been Verified.

EICR

EICR documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

Gas Safety

Gas Safety documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

EPC

EPC documentation has been provided to Let Property and has been Verified.

Interactive street-level view of the property location and surrounding area.

Appreciation

Service Charge

Indicated