- 5 Bedroom Mid-Terraced HMO

- On-Street Parking

- Buy-to-Let Opportunity

- Tenants Currently Situated

- Likely to attract enquiries from Serious Investors & Developers.

- INVESTMENT POTENTIAL DETAILED BELOW (Let Property Pack)

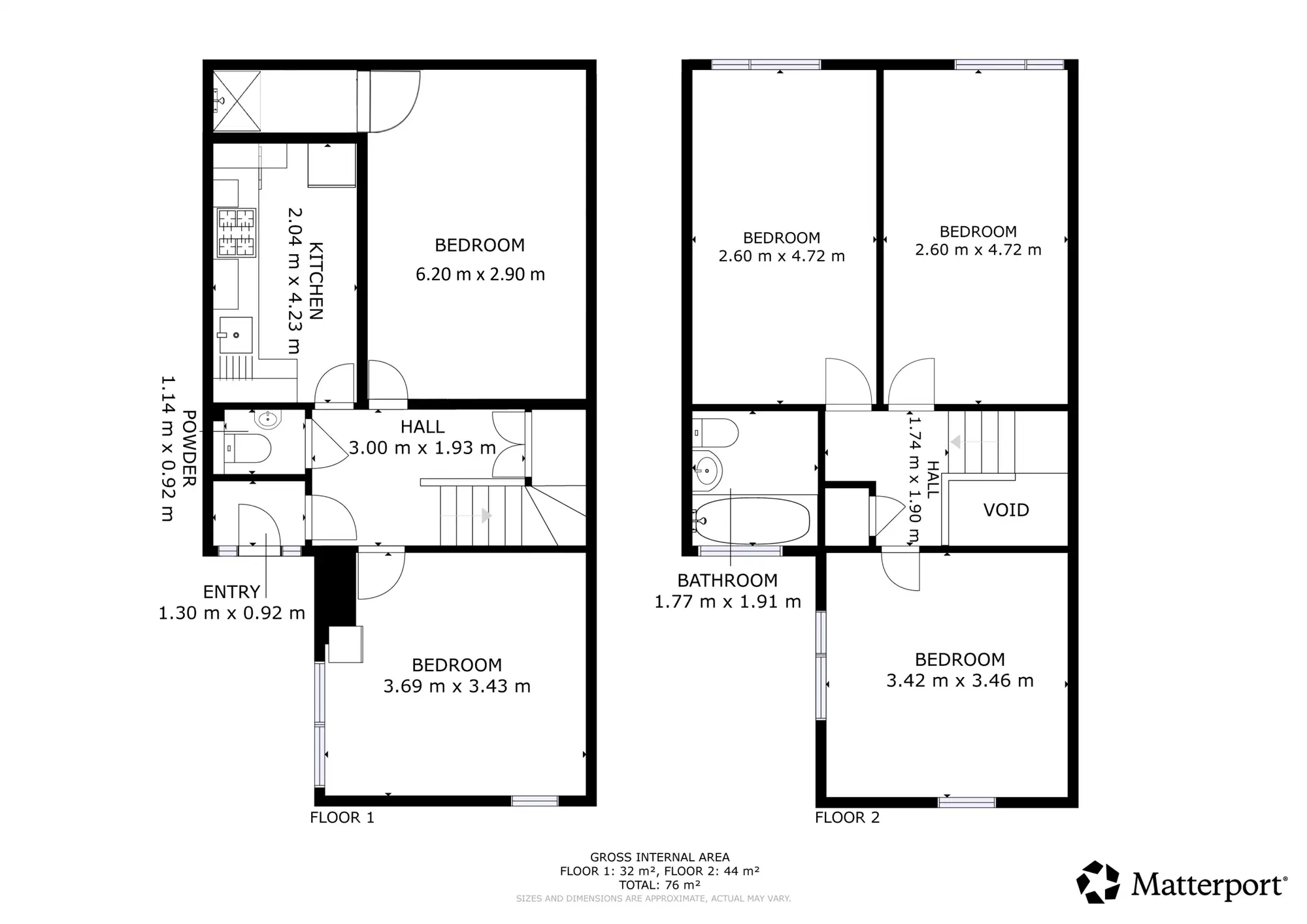

A 5-bedroom mid-terraced house located in Wembley is currently being used as an HMO. The property is within walking distance of various valuable amenities and offers excellent rental return potential.

For investors looking for a rewarding investment, this is a brilliant opportunity!

This fully HMO-compliant property offers five spacious rooms, with four currently occupied and one currently used as storage but easily converted into a fifth rentable bedroom. It benefits from two modern bathrooms, a well-equipped communal kitchen, convenient on-street parking, and a private rear patio.

Investment details

It currently produces an annual gross income of £37,320 with four tenants currently situated and with the potential of the fifth room also being let, this could instantly rise to £46,200. Considering the purchase price and the potential rental income that could be earned in future years, this will make for a worthwhile addition to an investor's property portfolio.

For greater detail on this property's investment potential, please see the Let Property Pack linked below.

If you are interested, please call us.

Let Property is committed to facilitating a smooth transaction process between buyer and seller. To allow for maximum commitment to the sale from both parties, a Buyer's Premium will apply in order to secure a property.

Tenancy Checks

Tenancy Agreement

Proof of Rental Income documentation has been verified against the rental amount in the Tenancy Agreement by Let Property.

Proof of Rental Income

Recent Proof of Rental Income has been Verified by Let Property.

Length of Tenancy

Length of Tenancy has been verified by Let Property by reviewing the date from when the provided tenancy documentation began.

Tenant Means of Funding:

Self Funded

Length of Tenancy information has been provided by the seller as verbal and written confirmation.

Property Checks

Property Tenure

Verified as Freehold

Property Tenure documentation has been provided to Let Property and has been Verified.

EICR

EICR documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

Gas Safety

Gas Safety documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

HMO License

HMO License documentation has been provided to Let Property and has been Verified.

EPC

EPC documentation has been provided to Let Property and has been Verified.

Council Tax Band

Council Tax Band: D

Interactive street-level view of the property location and surrounding area.

Appreciation

Service Charge

Indicated