- Buy-to-Let Opportunity

- Tenants currently situated

- Likely to attract enquiries from Serious Investors & Developers

- Well-Maintained Property

- 1 Bathroom and a separate WC

- Melton Mowbray is known for its food, charming market town atmosphere

- Close to high schools in Melton, including John Ferneley College

- The property is within walking distance of Melton Country Park

- in proximity to both the countryside and larger cities like Nottingham and Leicester

- Communal resident's parking available

- Low-maintenance, paved rear garden for easy upkeep

- Easy Access to Local Amenities

- INVESTMENT POTENTIAL DETAILED BELOW (Let Property Pack)

Our latest listing is a 2-bedroom end-of-terrace house located in Melton Mowbray . It is conveniently close to essential amenities, offers strong potential for rental returns, and currently has a tenant in residence.

For investors looking to expand their portfolio, this is a fantastic opportunity!

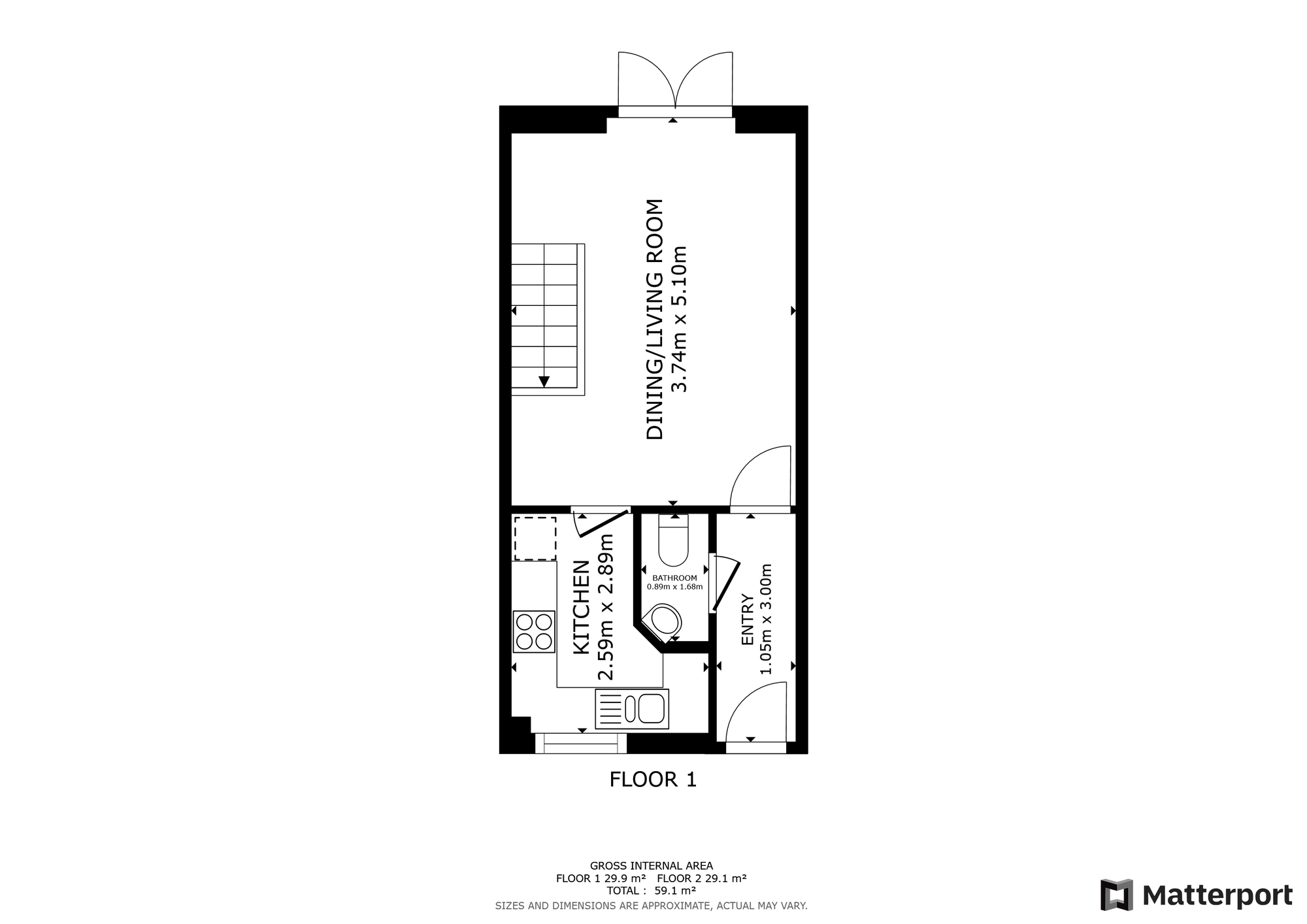

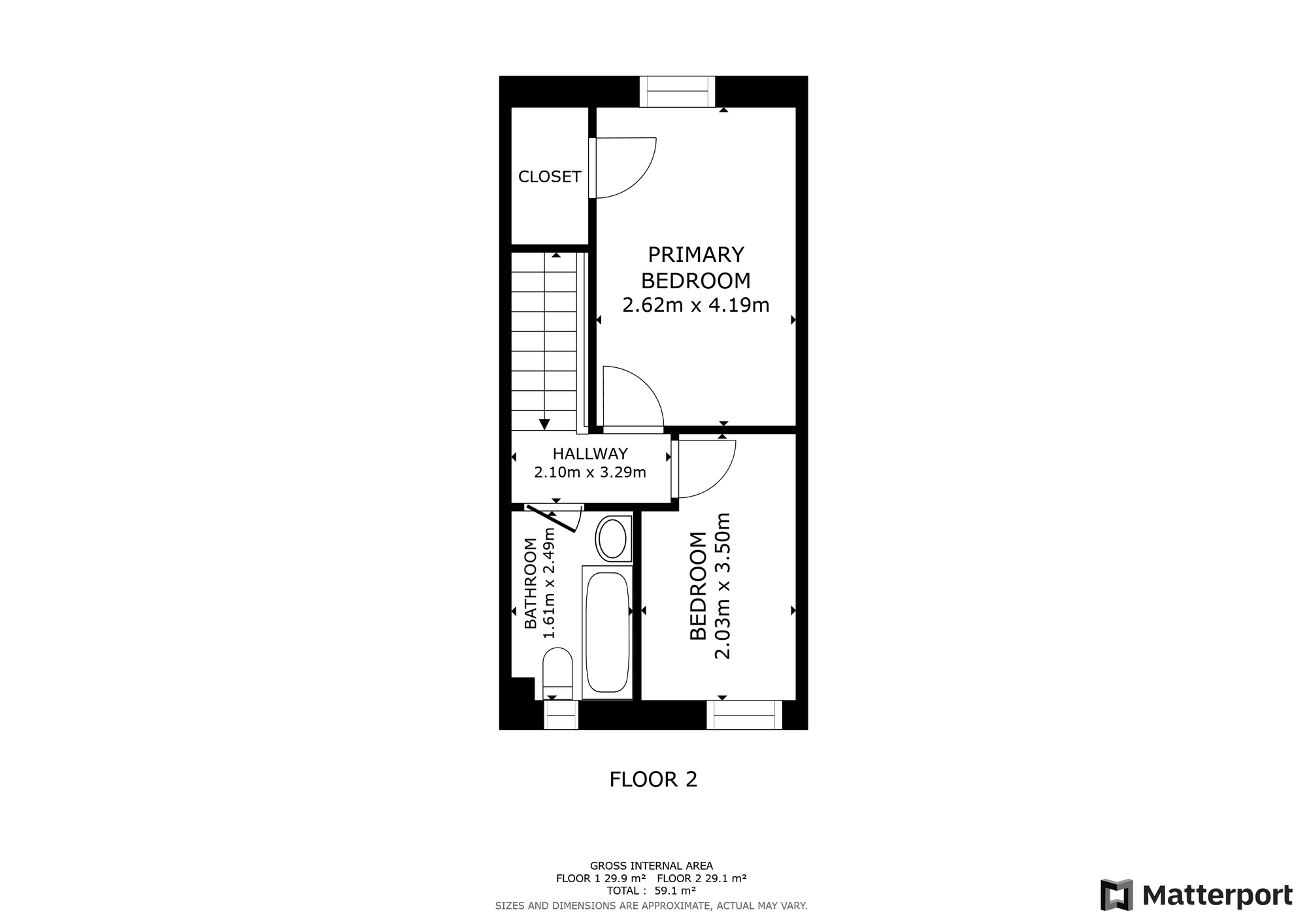

This well-maintained two-bedroom home features a bathroom and a separate WC, a lounge, and a kitchen. Additional highlights include access to communal residents' parking and a low-maintenance paved rear garden, ideal for hassle-free outdoor living.

Melton Mowbray is celebrated for its rich culinary heritage and quintessential market town charm. The area boasts a range of local amenities and is conveniently close to well-regarded schools, including John Ferneley College. Just a short walk from Melton Country Park, the location offers an ideal blend of peaceful countryside living with easy access to major cities like Nottingham and Leicester.

Investment details

It currently produces an annual gross income of £10,500, which the new owner could increase to a market rate of £13,800 with tenants currently situated. Considering the purchase price, this will make for a worthwhile addition to an investor's property portfolio.

Please see the Let Property Pack linked below for greater details on this property's investment potential.

If you are interested, please call us.

Tenancy Details

The current tenants have been residing in the property for less than a year and have consistently paid their rent on time. They do not plan to move out and wish to continue their tenancy.

Let Property is committed to facilitating a smooth transaction process between buyer and seller. To allow for maximum commitment to the sale from both parties, a Buyers Premium will apply in order to secure a property

Tenancy Checks

Tenancy Agreement

Proof of Rental Income documentation has been verified against the rental amount in the Tenancy Agreement by Let Property.

Proof of Rental Income

Recent Proof of Rental Income has been Verified by Let Property.

Length of Tenancy

Length of Tenancy has been verified by Let Property by reviewing the date from when the provided tenancy documentation began.

Tenant Means of Funding:

Self Funded

Length of Tenancy information has been provided by the seller as verbal and written confirmation.

Property Checks

Property Tenure

Verified as Freehold

Property Tenure documentation has been provided to Let Property and has been Verified.

EICR

EICR documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

Gas Safety

Gas Safety documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

EPC

EPC documentation has been provided to Let Property and has been Verified.

Council Tax Band

Council Tax Band: B

Interactive street-level view of the property location and surrounding area.

Appreciation

Service Charge

Indicated