- Street Parking

- Private Garden (Back Only)

- Buy-to-Let Opportunity

- Long Term Tenants Currently Situated

- Likely to Attract Inquiries from Serious Investors & Developers

- INVESTMENT POTENTIAL DETAILED BELOW (Let Property Pack)

This 5 bedroom end of terrace house in Northampton offers a prime investment opportunity. It boasts valuable amenities in close proximity, promising rewarding rental returns and a current tenant.

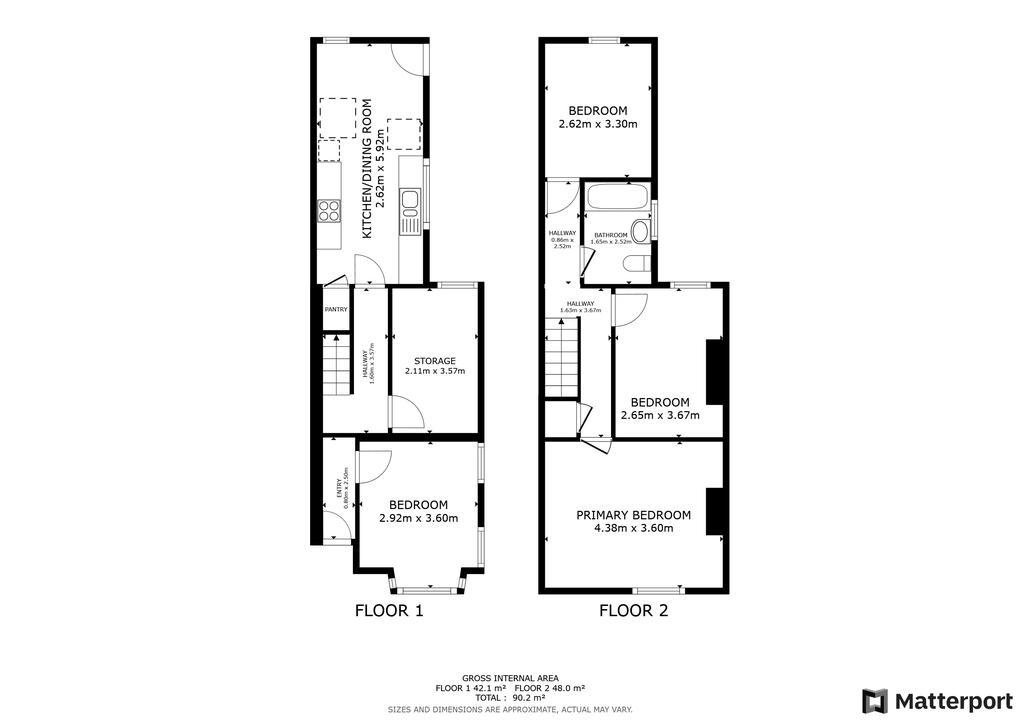

The well-maintained property features 5 bedrooms, three-piece bathroom, kitchen, service area and rear garden space.

Investment Details:

The property currently generates an annual gross income of £22,800 which has the potential to be increased to a market rate of £28,200 with the current tenants in place. Considering the purchase price, this investment presents a substantial opportunity for investors seeking to expand their portfolio.

For further details on the property’s investment potential, please refer to the attached Let Property Pack. Should you express interest in this property, please contact us.

Tenancy Details:

The current tenants have consistently paid their rent throughout their tenancy and have no intention of relocating. They are committed to remaining in the property.

Let Property is committed to facilitating a smooth transaction process between buyer and seller. To allow for maximum commitment to the sale from both parties, a Buyers Premium will apply in order to secure a property

Tenancy Checks

Tenancy Agreement

Proof of Rental Income documentation has been verified against the rental amount in the Tenancy Agreement by Let Property.

Proof of Rental Income

Recent Proof of Rental Income has been Verified by Let Property.

Length of Tenancy

Length of Tenancy has been verified by Let Property by reviewing the date from when the provided tenancy documentation began.

Tenant Means of Funding:

Self Funded

Length of Tenancy information has been provided by the seller as verbal and written confirmation.

Property Checks

Property Tenure

Verified as Freehold

Property Tenure documentation has been provided to Let Property and has been Verified.

EICR

EICR documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

Gas Safety

Gas Safety documentation has been provided by the seller as verbal and written confirmation of availability and documentation will be provided at Completion once the property has been secured.

HMO License

HMO License documentation has been provided to Let Property and has been Verified.

EPC

EPC documentation has been provided to Let Property and has been Verified.

Council Tax Band

Council Tax Band: A

Interactive street-level view of the property location and surrounding area.

Appreciation

Service Charge

Indicated